FDIC Insurance Over $250,000

It’s not uncommon for a business to deposit more money than the FDIC’s $250,000 limit, but that doesn’t mean you can’t be protected for higher amounts. We can help you insure millions through an IntraFi Network Deposit Account.

Ameris bankers make it easy to insure your deposits. Avoid the time-consuming hassle of opening accounts at different banks to keep your deposits insured. With just one Ameris Bank IntraFi Network Deposit Account, you can stay protected for any amount.

Don’t wait, insure all your business deposits today.

SAFEGUARD YOUR DEPOSITS.

Ameris Bank is a member of IntraFi Network Deposits allowing us to insure your deposits, no matter the amount, are covered by FDIC insurance, with no additional effort from you.1

- Work with just Ameris Bank and receive just one regular statement

- Access your funds through a single checking or money market account

- Simplify reporting by eliminating ongoing collateral tracking and the need to footnote uninsured deposits in financial statements

Introduction to IntraFi Cash Service

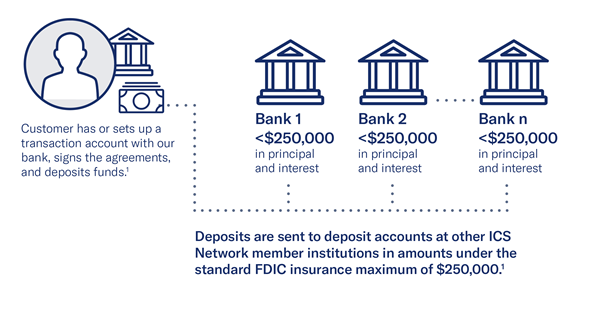

How does It work?

Like other institutions that offer IntraFi Network Deposits, we are members of a special network. When we place your deposit through IntraFi Network Deposits, the deposit is divided into amounts under the standard FDIC insurance maximum of $250,000. We then place these amounts into deposit accounts at multiple FDIC-insured banks. As a result, you can access FDIC coverage from many institutions while working directly with Ameris Bank.

What else do you need to know?

You’ll receive a regular monthly statement from us showing your demand and savings balances and other key information. And you can check your balances and track other important information online, 24/7. Your confidential information remains protected.

Get Started

1 Placement of funds through IntraFi Network Deposits is subject to the terms, conditions, and disclosures in the program agreements, including the Deposit Placement Agreement (“DPA”). Limits apply. Although funds are placed at destination banks in amounts that do not exceed the FDIC standard maximum deposit insurance amount (“SMDIA”), a depositor’s balances at the relationship institution that places the funds may exceed the SMDIA (e.g., before settlement for a deposit or after settlement for a withdrawal) or be ineligible for FDIC insurance (if the relationship institution is not a bank). As stated in the DPA, the depositor is responsible for making any necessary arrangements to protect such balances consistent with applicable law. If the depositor is subject to restrictions on placement of its funds, the depositor is responsible for determining whether its use of IntraFi Network Deposits satisfies those restrictions. Network Deposits and the IntraFi hexagon are service marks, and IntraFi and CDARS are registered service marks, of IntraFi Network LLC.

Ameris Bank is a financial institution serving customers across the Southeast and Mid-Atlantic. Customers can benefit from Ameris Bank products and services through online account opening. Ameris Bank has full-service locations in Alabama, Florida, Georgia, North Carolina, and South Carolina and mortgage-only locations in Alabama, Georgia, Florida, South Carolina, North Carolina, Virginia, Maryland, and Tennessee.