Wholesale Mortgage Lending

Delivered through a highly experienced mortgage team, Ameris Bank's wholesale/correspondent services* are available to lenders across the U.S. Give your borrower the right solution at the right time, and receive the highest level of service throughout the process.

-

Education for your staff

-

Wide range of products, including government programs

-

In-house underwriting and processing

-

Available to banks, credit unions, mortgage lenders and brokers

Far more than a transaction

For your borrowers, buying a home is one of the biggest transactions they will ever complete. For you as a lender, your choice of a mortgage partner is bigger than any single transaction. By choosing Ameris Bank, you're choosing a relationship-driven wholesale/correspondent partner that truly cares about empowering your agents, boosting your business and taking care of your borrowers.

Wholesale Products and Programs

A fixed-rate mortgage loan may be a good option if your client expects interest rates to rise in the future, plans to stay in the home for an extended period of time or prefers the stability of monthly payments.

-

Interest rate stays the same for the entire term. Monthly principal and interest payments will remain the same for the life of the loan.

-

Available in a variety of term lengths.

Considerations:

-

How the length of the loan term will affect the payment amount and how much is paid in interest in the long-run.

-

The monthly payment is typically higher on a shorter-term loan than on a longer-term loan.

-

The total interest paid is higher on a longer-term loan than on a shorter-term loan.

An adjustable-rate mortgage loan, or ARM, may be a good option to consider if your client thinks interest rates will fall in the future, plans to stay in the home for only a short period of time or expects future income growth.

-

Interest rate rises and falls with the market interest rates. Monthly principal and interest payments will change depending on the market interest rate at that time.

-

Low interest rate during the initial period allows for payments to be lower when compared to payments of a fixed-rate mortgage. After the initial payment period has expired, the mortgage rate for the loan will fluctuate to the index rate.

-

Includes an interest rate cap that sets a limit on how high the rate can go. A cap limits the maximum amount the monthly payment will increase at each interest rate adjustment over the life of the loan.

-

Available in a variety of term lengths.

Considerations:

-

The effects of the adjustable rate over time.

-

Monthly payments may increase when the interest rate adjusts.

-

Monthly payments may change every year after the initial fixed period is over.

Offered through the Federal Housing Administration, FHA loans are available to borrowers of all income levels. Allows for a co-applicant to help the borrower qualify even if they will not live in the home. May be a good option to consider if your client expects to buy a lower priced home with a small down-payment or has less cash available up front for the down-payment and closing costs.

-

Low down-payment options

-

Available for a variety of loan terms

-

Requires mortgage insurance

-

Flexible income, debt, and credit requirements

-

Down-payment and closing costs may come from a gift or grant

-

A co-applicant can help you qualify even though they do not live in the home

-

Available in a variety of fixed-rate and adjustable rate loan options

Considerations:

-

The borrower typically must pay both up-front and monthly FHA mortgage insurance premiums.

-

The borrower typically can only have one FHA mortgage at a time.

Offered through the Veterans Administration, VA loans are available to borrowers who are eligible service members. Veterans must provide a veteran’s certificate of eligibility and the appraisal is assigned by the VA.

-

Financing for eligible service member (veterans, reservists, active duty personnel or eligible family members)

-

Low-to no-down payment options available

-

No mortgage insurance requirement

-

Flexible income, debt and credit requirements

-

Down payment and closing costs may come from a gift or grant

-

Available in a variety of fixed-rate and adjustable rate loan options

-

Potential for minimal out-of-pocket expenses with seller contributions

Considerations:

-

The borrower typically must pay a one-time VA funding fee that can be financed into the amount of the loan.

-

Financing is available only for primary residences.

Offered through the United States Department of Agriculture, a USDA loan may be a good option for clients who expect to buy a home in a rural area or have less cash available up-front for down-payment and closing costs.

-

Lending up to 100 percent of the appraised value of the home.

-

One-time guarantee fee may be rolled into the loan amount

-

Restrictions based on income and location.

An excellent (and sometimes the only) option for clients purchasing homes valued in excess of conforming loan limits.

-

Available for primary and secondary homes

-

Purchase or refinance allowed

-

Financing available in fixed rate and ARM options

-

Max LTV of 65%-70% for loans up to $2,000,000

-

Max LTV of 70%-80% for loans up to $1,500,000

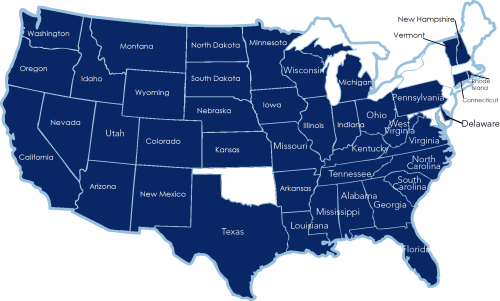

With a highly experienced team of wholesale/correspondent account representatives throughout the nation, we are proud to serve mortgage partners in 45 states (all the states appearing in blue).

East Coast Team

1800 Parkway Place, Suite 820 Marietta, GA 30067 | 770-578-3600

Tiffany Lehrer, Sales Manager | tiffany.lehrer@amerisbank.com | 770-712-2713

Brian Brewer, Operations Manager | brian.brewer@amerisbank.com | 770-499-2804

James Grill, Wholesale Account Executive | james.grill@amerisbank.com | 678-628-7762

Vicki Blum, Wholesale Account Executive | vicki.blum@amerisbank.com | 404-281-6924

West Coast Team

1110 Iron Pont Road, Suite 180 Folsom, CA 95630 | 916-850-1530

Terry Alessi, West Coast Manager | terry.alessi@amerisbank.com | 915-850-1520

Sean Hennessy, Sales Manager | sean.hennessy@amerisbank.com | 620-235-5771

Connie Prince, Operations Manager | connie.prince@amerisbank.com | 916-850-1277

Mike Hart, Wholesale Account Manager | mike.hart@amerisbank.com | 417-894-2563

Denise Lynn, Wholesale Account Manager | denise.lynn@amerisbank.com | 414-510-3798

JD Meadows, Wholesale Account Manager | jd.meadows@amerisbank.com | 415-637-8263

Jennifer Neumann, Wholesale Account Manager | jennifer.neumann@amerisbank.com | 808-306-0647

Pam Daine, Wholesale Account Manager | pam.daine@amerisbank.com | 832-349-6362

Sandra Vang, TRID Support | sandra.vang@amerisbank.com | 916-618-6105

Lee Britton, Production Support | lee.britton@amerisbank.com | 916-850-1295

Let's work together to make your borrowers' dreams come true. You'll receive 24/7 access to your online pipeline through our secured LOS and pricing engine. And, you'll get the support you need from real people right here at Ameris.

* All loans subject to credit approval.

Ameris Bank is a full-service financial institution serving customers in the Southeast and Mid-Atlantic.